After the different proposals made by the Ministry of Inclusion, Social Security and Migration, the RETA fee will range between a range of net income and will be adjusted until 2025.

According to the latest proposal to modify the quotation system:

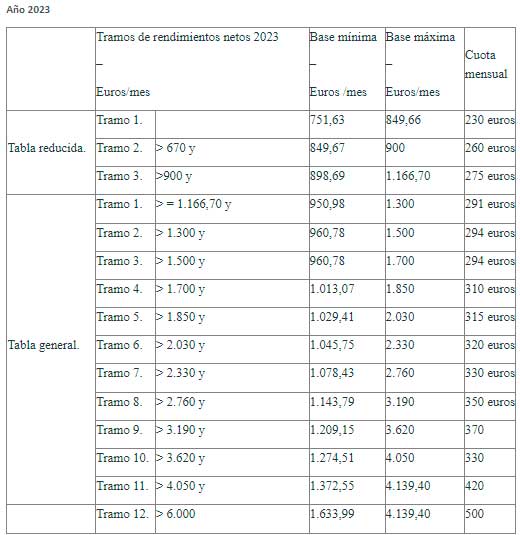

In accordance with the provisions of DT 1 of Royal Decree-Law 13/2022, the general and reduced tables in force for each year in this period 2023 to 2025 are as follows:

Income brackets and interprofessional minimum wage

As is known, the regulations (both the historic Decree 2530/1970, of August 20, at the time, and the current Law 20/2007, of July 11, on the status of self-employed workers), do not specify any economic threshold for the obligation to register in the RETA.

However, the jurisprudence has been estimating the exceeding of the threshold of the SMI (minimum interprofessional salary), received in the calendar year, as an indicator of it.

Starting from the SMI for the year 2022 (14.000 euros), the self-employed who exceed this reference limit would contribute 291 euros/month in 2023 (maintaining for 2024 and 2025).

In case of not reaching it, now, they must be placed in sections 3, 2, or 1, trading for 230, 260 or 275 euros, respectively, in the year 2023.

If you want to know more you can contact us by clicking: HERE