5. The amounts of the economic benefits to which the the self-employed during the period or periods in which they benefit from the reduced quota regulated in this article, they will be determined in accordance with the amount of the minimum base of the lower section of the general table of bases that is applicable during them, contemplated in rule 1 .ª of article 308.1.a) of the revised text of the General Social Security Law.

6. The reduced quota will not be subject to regularization, in accordance with the provisions of article 308.1.c) of the revised text of the General Social Security Law, during the period provided for in section 1.

During the period provided for in section 2, the regularization will not take effect if, in the year or years covering the net economic returns of the self-employed would have been lower than the minimum annual interprofessional salary in force in each of those years.

If in the year or years covered by the second period, the economic returns exceed the amount of the minimum salary interprofessional contract in force in any of them, the reduced contribution in the year in which this circumstance occurs, will be subject to the corresponding regularization.

For this purpose, of the yields obtained during the year in which said amount is exceeded, the proportional part of said yields, corresponding to the months affected by the reduction, will be taken into consideration for the regularization.

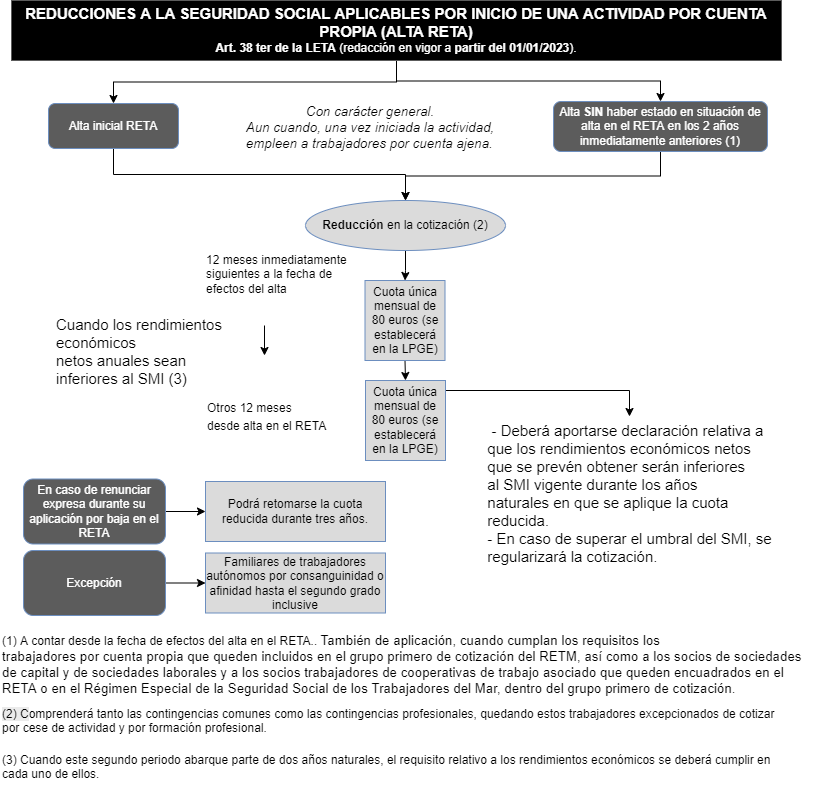

7. The provisions of this article will be applicable even when the beneficiaries of the reductions, once their activity has begun, employ workers for another's account.

8. At the end of the maximum period of enjoyment of the reductions in the contribution contemplated in this article, the contribution will proceed for all the protected contingencies from the first day of the month following the one in which said termination occurs.

9. The provisions of the preceding sections shall also apply, when they meet the requirements established therein, to self-employed workers who are included in the first contribution group of the Special Scheme of Social Security for Sea Workers, as well as well as the members of capital companies and labor companies and the worker members of associated work cooperatives that are framed in the Special Regime of the Social Security of Self-Employed or Self-Employed Workers or in the Special Regime of the Social Security of the Workers of the Sea, within the first group of quotation.

10. The reductions in the contribution provided for in this article will not be applicable to the relatives of self-employed workers by blood or affinity up to the second degree inclusive and, where appropriate, by adoption, who are incorporated into the Special Scheme of the Social Security of the Self-Employed or Self-Employed Workers or, as self-employed workers, to the first contribution group of the Special Social Security Scheme for Sea Workers, nor to members of institutes of consecrated life of the Catholic Church included in the first of these regimens.

11. The reductions in quotas provided for in this article will be financed from the contributions of the State to the Social Security budgets destined to finance reductions in the contribution.»

Do you want to know more?

Contact us through our form and we will be happy to advise you.